Retirement Planning

Retirement Planning Questions sound like…

- Do I have enough to retire?

- Am I invested the right way?

- When should I start OAS and CPP?

How Do I Continue to Have Impact and Influence After I Retire?

Living A Purpose-Driven Retirement

These upcoming years could be the best years of your life and there’s so much to look forward to.

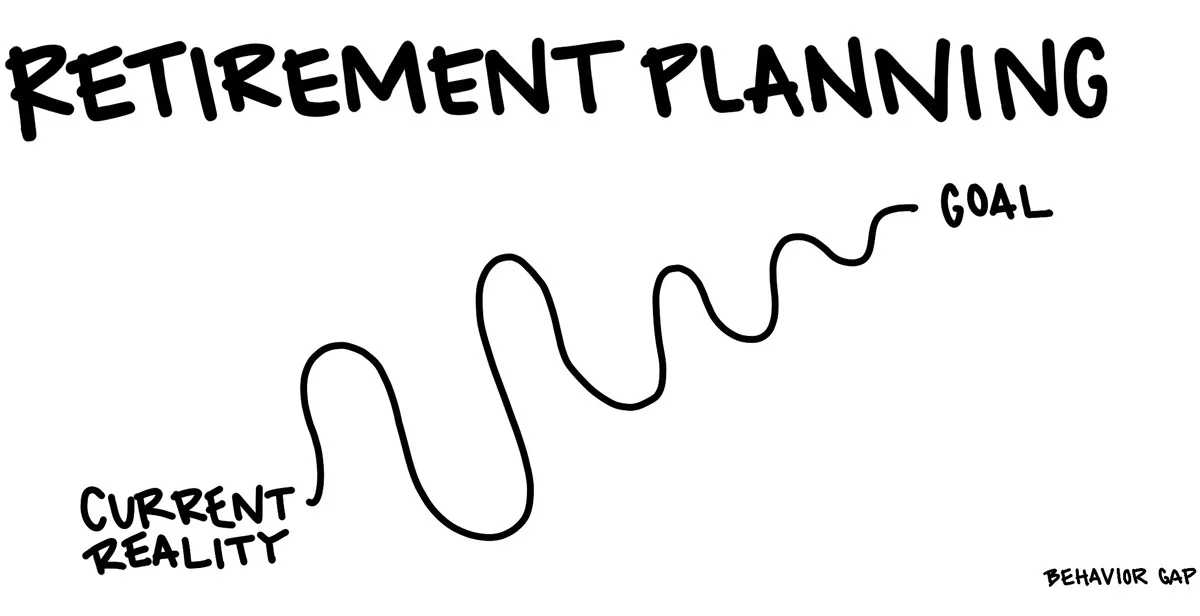

But I’ve often seen that the financial part of people’s retirement lives can cause them stress and it limits the enjoyment of these important years.

I’m here to remove the burden and stress that comes with planning retirement so that you can get a crystal clear, simplified plan that will give you the confidence you need to live a purpose-driven retirement.

It all starts with a free planning session. Click here to schedule yours.

You don’t have to prepare anything. I’ll just ask you really good questions.

5 Mini-Plans in Every Big Retirement Plan

When it comes to proper retirement planning, there are 5 key parts to get right so that you can feel confident that you’re not missing anything.

They are:

- The Income Plan

- The Investment Plan

- The Tax Plan

- The Healthcare Plan

- The Legacy/Charitable Plan

If your plan includes these 5 key parts, you’ll feel good knowing that you have a comprehensive plan in place.

Increasing Your Peace of Mind

Wendy and Lee were getting close to the point where they wanted to work less and enjoy their friends and family more.

They had done a good job of saving but they wanted to get another opinion to make sure they were covering all their bases.

They reached out for a free planning session and got a gameplan with all the next steps they should be taking.

This gave them the confidence they needed to take the next step into this new stage of life.

Retirement is Like Baking a Cake

The best way to bake a cake is to have a recipe follow, right? You need the ingredients added at the right time in order for the cake to be a success.

The same goes for planning for retirement. I’ve compiled over 70 “ingredients” we use to create successful retirement plans.

Depending on their situation, it’s common for our clients to only need 15-20 ingredients in order to have a plan that works. The trick is adding them at the right time to get the right result.

In our 2nd meeting with you, you’ll receive your own list of ingredients and next steps to follow.

Which Retirement Withdrawal Strategy Makes the Most Sense for You?

There are a number of options out there.

They all have the same goal – to have a sustainable income that won’t run out and won’t be affected by market swings.

The right strategy depends on your ability to handle risk, how much you need, and what you have saved.